In this comprehensive guide, we delve into the intricacies of here are simplified financial statements for watervan corporation, empowering you with the knowledge to decipher the financial health of this esteemed organization. We will navigate the balance sheet, income statement, cash flow statement, and key financial ratios, providing a clear understanding of Watervan Corporation’s financial performance.

Through a simplified and engaging approach, we aim to demystify the complexities of financial statements, enabling you to make informed decisions and gain valuable insights into the financial landscape of Watervan Corporation.

Financial Statements Overview: Here Are Simplified Financial Statements For Watervan Corporation

Financial statements are essential tools for businesses to track their financial performance, make informed decisions, and provide transparency to stakeholders. They provide a comprehensive overview of a company’s financial health and are used by investors, creditors, and management to assess the company’s strengths, weaknesses, and overall viability.

The three main types of financial statements are the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

The income statement summarizes the company’s revenues and expenses over a period of time, resulting in net income or loss. The cash flow statement tracks the movement of cash and cash equivalents in and out of the business, providing insights into the company’s liquidity and financial flexibility.

Watervan Corporation is a publicly traded company that manufactures and distributes water filtration systems. The company’s financial statements provide valuable information to investors, creditors, and management, helping them to understand the company’s financial performance and make informed decisions.

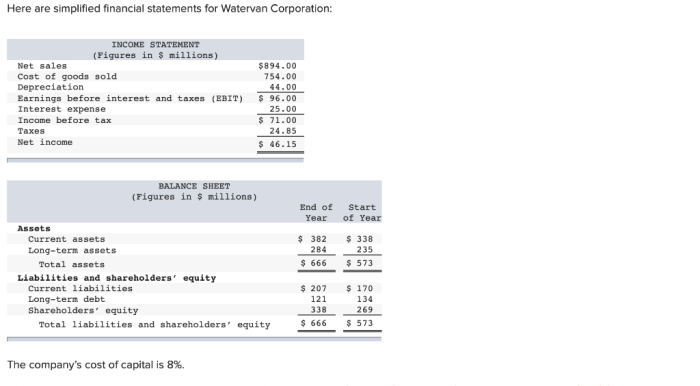

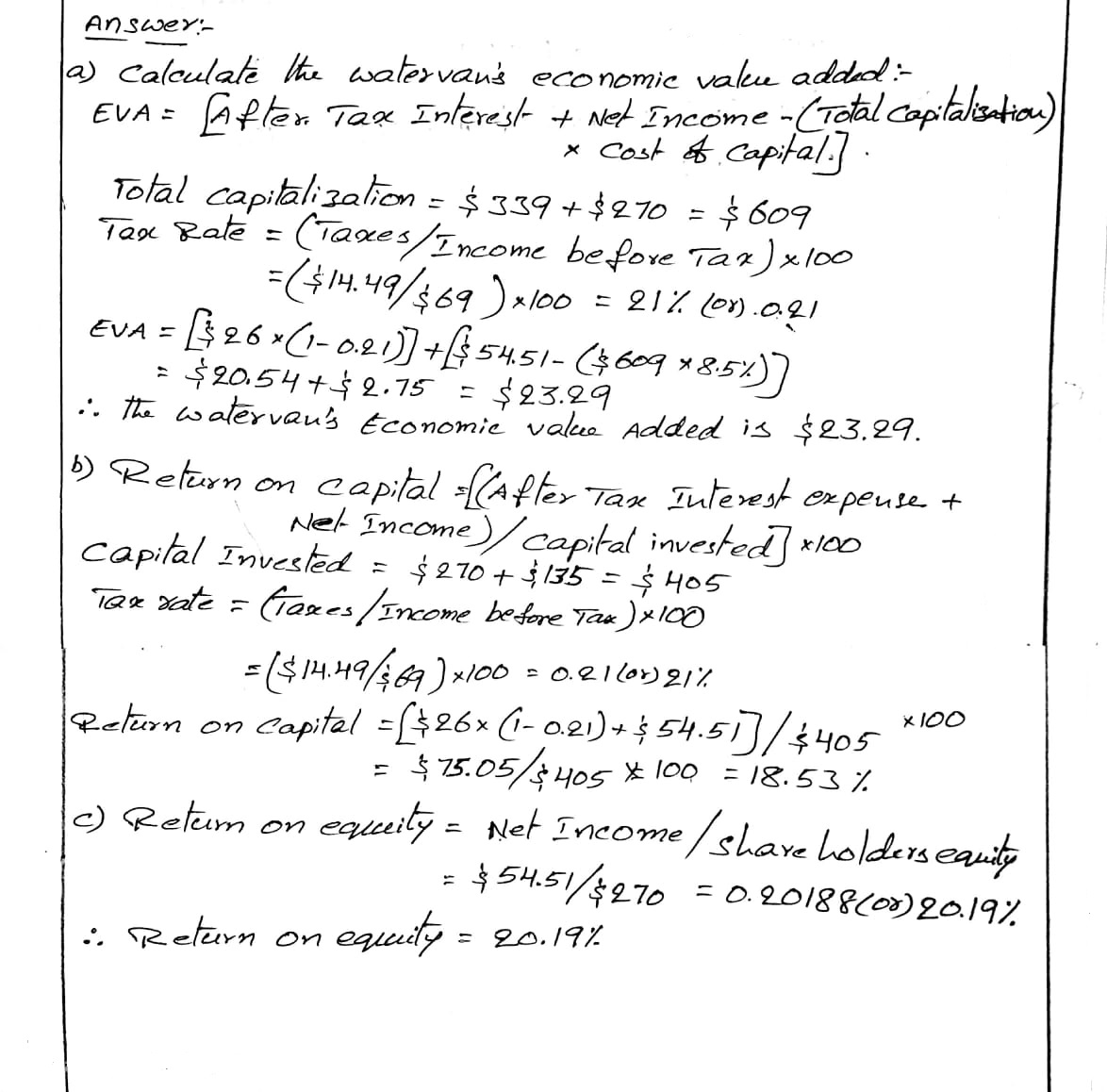

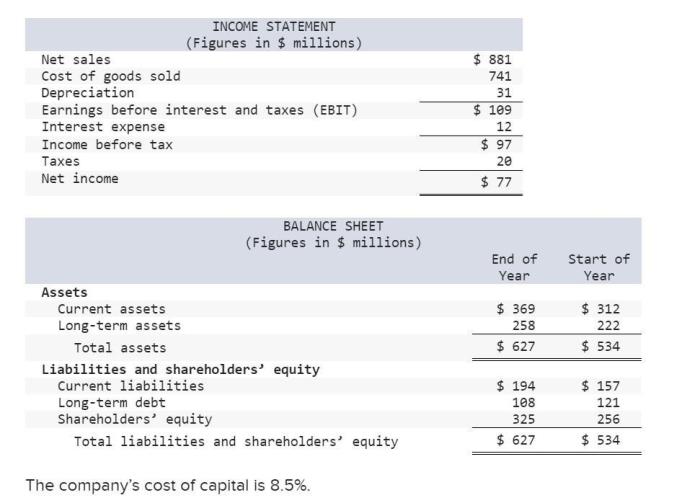

Balance Sheet, Here are simplified financial statements for watervan corporation

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is divided into three main sections: assets, liabilities, and equity.

- Assetsare resources owned or controlled by the company that have economic value. These include cash, accounts receivable, inventory, property, and equipment.

- Liabilitiesare obligations of the company that must be repaid or settled in the future. These include accounts payable, notes payable, and long-term debt.

- Equityis the residual interest in the company’s assets after deducting its liabilities. It represents the ownership interest of the company’s shareholders.

The balance sheet must always balance, meaning that the total assets must equal the total liabilities plus equity.

Simplified Example of a Balance Sheet for Watervan Corporation

| Assets | Liabilities | Equity |

|---|---|---|

| $100,000 | $50,000 | $50,000 |

Income Statement

The income statement is a financial statement that summarizes a company’s revenues and expenses over a period of time, resulting in net income or loss.

- Revenueis the income generated from the sale of goods or services.

- Expensesare the costs incurred in generating revenue, such as cost of goods sold, selling and administrative expenses, and interest expense.

- Net incomeis the difference between revenue and expenses. It represents the company’s profit or loss for the period.

Simplified Example of an Income Statement for Watervan Corporation

| Revenue | Expenses | Net Income |

|---|---|---|

| $150,000 | $100,000 | $50,000 |

Cash Flow Statement

The cash flow statement is a financial statement that tracks the movement of cash and cash equivalents in and out of the business.

- Operating activitiesinclude the cash generated from the company’s core operations, such as sales of goods or services.

- Investing activitiesinclude the cash used to purchase or sell long-term assets, such as property, plant, and equipment.

- Financing activitiesinclude the cash used to raise or repay debt or equity.

The cash flow statement provides insights into the company’s liquidity and financial flexibility.

Simplified Example of a Cash Flow Statement for Watervan Corporation

| Operating Activities | Investing Activities | Financing Activities |

|---|---|---|

| $50,000 | ($10,000) | $10,000 |

Financial Ratios

Financial ratios are used to analyze a company’s financial statements and assess its financial performance. There are many different types of financial ratios, each with its own purpose and interpretation.

- Liquidity ratiosmeasure a company’s ability to meet its short-term obligations. Examples include the current ratio and quick ratio.

- Solvency ratiosmeasure a company’s ability to meet its long-term obligations. Examples include the debt-to-equity ratio and the interest coverage ratio.

- Profitability ratiosmeasure a company’s profitability. Examples include the gross profit margin, operating profit margin, and net profit margin.

Financial ratios can be used to compare a company’s performance to its competitors, to industry benchmarks, or to its own historical performance. They can also be used to identify trends and to make informed decisions about the company’s financial future.

Examples of How Financial Ratios Can Be Used to Assess Watervan Corporation’s Financial Performance

- The current ratio can be used to assess Watervan Corporation’s ability to meet its short-term obligations. A current ratio of 2.0 or higher is generally considered to be healthy.

- The debt-to-equity ratio can be used to assess Watervan Corporation’s solvency. A debt-to-equity ratio of 1.0 or lower is generally considered to be healthy.

- The net profit margin can be used to assess Watervan Corporation’s profitability. A net profit margin of 10% or higher is generally considered to be healthy.

Q&A

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

What does the income statement show?

The income statement summarizes a company’s revenues, expenses, and net income over a period of time, typically a quarter or a year.

How can financial ratios be used?

Financial ratios are used to analyze a company’s financial performance and compare it to industry benchmarks or its own historical performance.