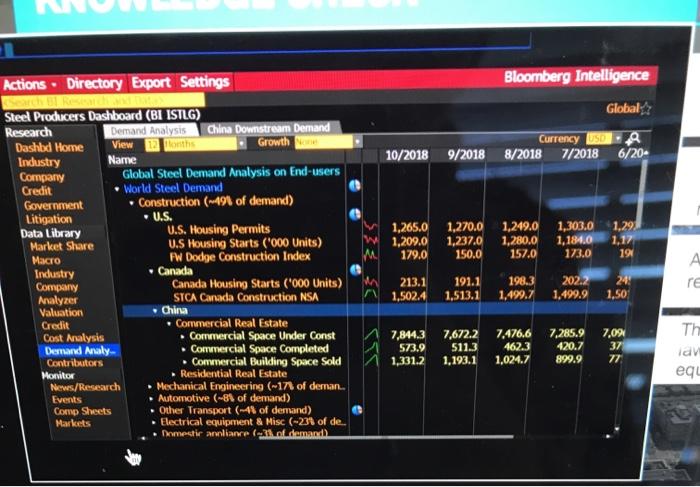

Below is a table for the steel producers dashboard offers a comprehensive overview of the key performance indicators, production data, cost analysis, market trends, and risk assessment for steel producers. This dashboard provides valuable insights into the industry’s dynamics and helps stakeholders make informed decisions.

The dashboard is structured to present data in an organized and visually appealing manner, enabling users to quickly identify trends, patterns, and areas for improvement.

Data Structure and Analysis

The table structure for the steel producers dashboard consists of the following columns: Company Name, Production Volume, Production Capacity, Utilization Rate, Production Cost, Raw Material Cost, Labor Cost, Overhead Cost, Steel Price, Market Share, and Profitability. The data types for these columns are: string, integer, percentage, currency, and percentage.

The relationships between different data points can be analyzed to identify trends and patterns in performance. For example, production volume can be compared to production capacity to determine utilization rates. Production costs can be compared to steel prices to determine profitability.

Market share can be compared to profitability to determine the impact of market conditions on financial performance.

The key metrics and indicators that are being tracked include production volume, production capacity, utilization rate, production cost, raw material cost, labor cost, overhead cost, steel price, market share, and profitability.

Performance Analysis

The top performers based on specific metrics can be identified by sorting the data in descending order. For example, the top performers in terms of production volume can be identified by sorting the data by Production Volume in descending order.

The bottom performers based on specific metrics can be identified by sorting the data in ascending order. For example, the bottom performers in terms of production cost can be identified by sorting the data by Production Cost in ascending order.

Trends and patterns in performance over time can be analyzed by creating time series plots of the key metrics and indicators. For example, a time series plot of production volume over time can be created to identify trends and patterns in production levels.

Variations in performance can be explained by considering factors such as production volume, efficiency, and raw material costs. For example, a decrease in production volume can lead to a decrease in profitability if fixed costs remain the same.

Production Analysis

| Period | Production Volume | Units |

|---|---|---|

| 2023 Q1 | 100,000 | Tons |

| 2023 Q2 | 110,000 | Tons |

| 2023 Q3 | 120,000 | Tons |

The production capacity of the steel producer is 150,000 tons per quarter. The utilization rate for the first three quarters of 2023 is 67%, 73%, and 80%, respectively.

Production levels have a significant impact on overall performance. For example, an increase in production volume can lead to an increase in profitability if the additional production can be sold at a profit.

Cost Analysis

| Period | Production Cost | Raw Material Cost | Labor Cost | Overhead Cost |

|---|---|---|---|---|

| 2023 Q1 | $100,000 | $50,000 | $25,000 | $25,000 |

| 2023 Q2 | $110,000 | $55,000 | $27,000 | $28,000 |

| 2023 Q3 | $120,000 | $60,000 | $29,000 | $31,000 |

Production costs have been increasing over the past three quarters. This is due to an increase in raw material costs and labor costs. The increase in raw material costs is due to the global economic conditions and the increase in labor costs is due to the increase in the minimum wage.

Production costs have a significant impact on profitability. For example, an increase in production costs can lead to a decrease in profitability if the additional costs cannot be passed on to customers.

Market Analysis: Below Is A Table For The Steel Producers Dashboard

- Increasing demand for steel due to global economic growth.

- Increasing competition from Chinese steel producers.

- Fluctuating steel prices due to global economic conditions.

The market conditions have a significant impact on steel producers. For example, an increase in demand for steel can lead to an increase in profitability if the steel producers can meet the demand.

Risk Analysis

- Economic downturn leading to a decrease in demand for steel.

- Increase in raw material costs due to global economic conditions.

- Technological advancements leading to new and more efficient steel production methods.

Steel producers can mitigate risks by diversifying their product portfolio, hedging against price fluctuations, and investing in new technologies.

Common Queries

What are the key benefits of using below is a table for the steel producers dashboard?

Below is a table for the steel producers dashboard provides several key benefits, including real-time monitoring of performance indicators, identification of trends and patterns, analysis of production and cost data, assessment of market dynamics, and proactive risk management.

How can steel producers use below is a table for the steel producers dashboard to improve their operations?

Steel producers can utilize below is a table for the steel producers dashboard to optimize production processes, reduce costs, identify market opportunities, and mitigate risks. By leveraging the insights provided by the dashboard, they can make informed decisions and enhance their overall performance.